Anyone who wants to purchase products or services for their company is faced with a question that's really not so easy to answer: Will the investment pay off for us? So the question to the respective provider or supplier almost automatically rolls off your tongue: "What's our ROI if I buy this?"

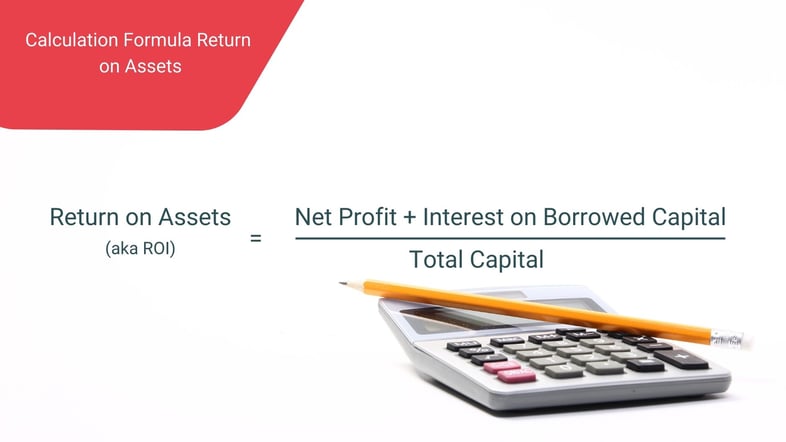

The basic idea is absolutely correct, but unfortunately it's rarely that simple to get there. ROI, or Return on Investment, is a business indicator that's supposed to help better assess profitability for companies. It's not as uniformly defined as one might think. In practice, for example, the Return on Assets is often calculated as ROI (Figure 1).

Figure 1: Calculation Formula for Return On Assets

Among experts, the informative value of this key figure is disputed, even for this purpose. If you also look at where ROI is placed in the Du Pont Analysis (something amounting to a pyramid for corporate performance indicators), for example, it quickly becomes clear that ROI is more likely to appear at the top of a performance indicator system. ROI is therefore not designed to be applied to individual investments or the outsourcing of services.

However, one could (and not infrequently does, for example, in the US) divide the surplus payments that can be attributed to the purchased service or product by the capital employed, multiply it by 100, and then have a sort of ROI for the investment. You could do this. The real problem, however, is that it's not possible to directly compare certain costs with revenues:

If the owner of a copy store buys a new laser printer/copier, they can calculate what income they'll generate with it and how this compares to their expenses. A mechanical engineering company that buys the same laser printer/copier, which is then used jointly by Development, Sales and Administration, can't calculate this so easily. When investments in technical documentation are under discussion, it's often the case that no direct revenues can be assigned to them. Although this doesn't always have to be the case, as we'll see in a moment, it usually is the case.

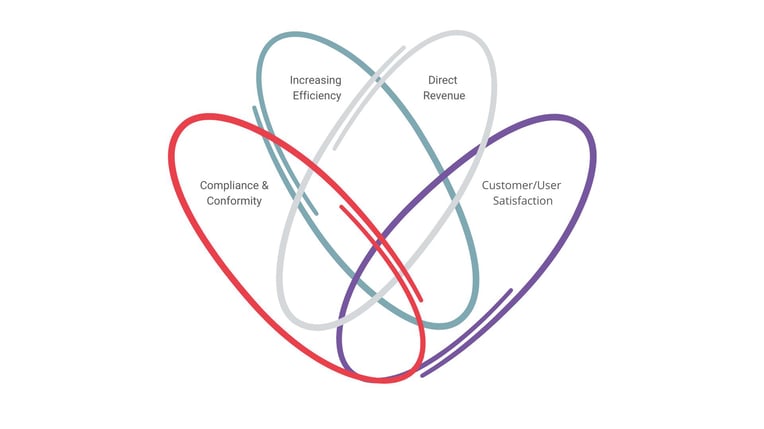

It's therefore necessary to determine the "Return on Information" in order to be able to determine which investments can be justified: What value does the information created within the company or by a service provider actually create? In order to quantify this created value, the company's own key performance indicators must first be developed. These can be sorted into four categories (or combinations of these categories):

Figure 2: Value Creation Categories in Technical Documentation

Compliance and Conformity

Technical documentation must mostly comply with legal, normative, contractual or approval requirements.

Customer/User Satisfaction

Usability, satisfaction, user behaviour, and much more. ("Are manufacturers giving away one of their most valuable data assets?") can be checked and measured, for example.

Increasing Efficiency

According to the Insight Report Service 2023 (available in German, only), almost 20% of all service technicians spend between one and two hours every day searching for the information they need to complete their tasks.

Direct Revenue

Digital Assistants for optimised troubleshooting, individual learning offers, augmented reality support, access to managed user communities: there are many ways to also generate and measure direct revenue through an expansion of technical documentation.

Metrics can fall into one or more of these categories (Figure 2). The categories can help in identifying metrics for the value provided by technical documentation.

In any case, it's worthwhile to identify them, because this is the only way to put the metrics that quantify the effort required to create technical documentation into perspective. If companies now develop and maintain key figures for the value created, as well as for the creation effort, the cost-benefit ratio can be assessed correctly. In other words, they determine the Return on Information.